Published on December 31, 20244 min read

In the realm of real estate, foreclosed properties present a unique opportunity for homebuyers and investors alike. These properties, often sold at a fraction of their market value, can be enticing options for those looking to purchase a home or investment property. This paper will explore what foreclosed properties are, the process of buying them, and the advantages they offer.

What are Foreclosed Properties?

Foreclosed properties are homes that have been repossessed by a lender due to the previous owner's inability to meet mortgage payments. When a homeowner defaults on their mortgage, the lender initiates a legal process known as foreclosure, ultimately resulting in the sale of the property to recover the outstanding debt. Once a property is foreclosed, it is typically sold at a public auction or through a real estate agent, and the new owner acquires the property free of the previous owner's debt obligations.

Foreclosures can occur for various reasons, including job loss, financial hardship, or unexpected medical expenses. These circumstances often lead to a significant decrease in the property's value, making foreclosed homes attractive to buyers looking for a bargain.

Purchasing a foreclosed property involves several steps:

Research and Understand the Market: Before diving into the purchase process, it is crucial for buyers to familiarize themselves with the local real estate market. Understanding property values in the area can help buyers identify potential deals and avoid overpaying.

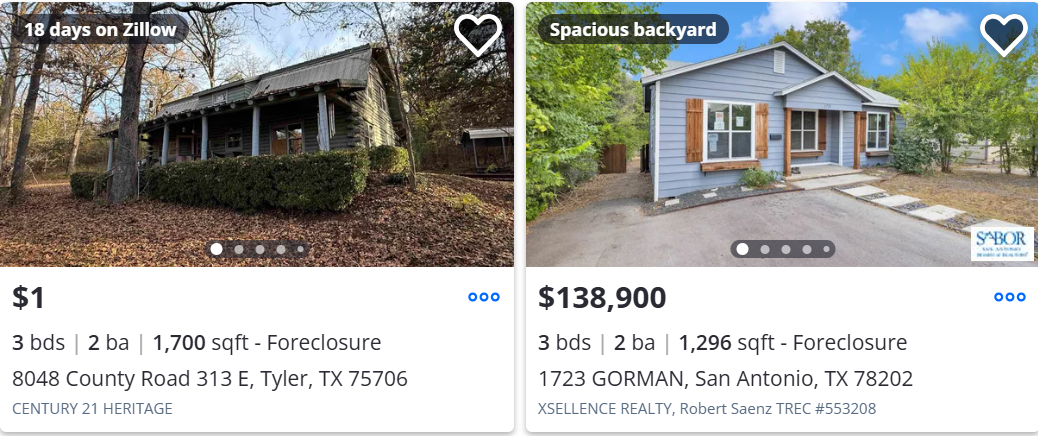

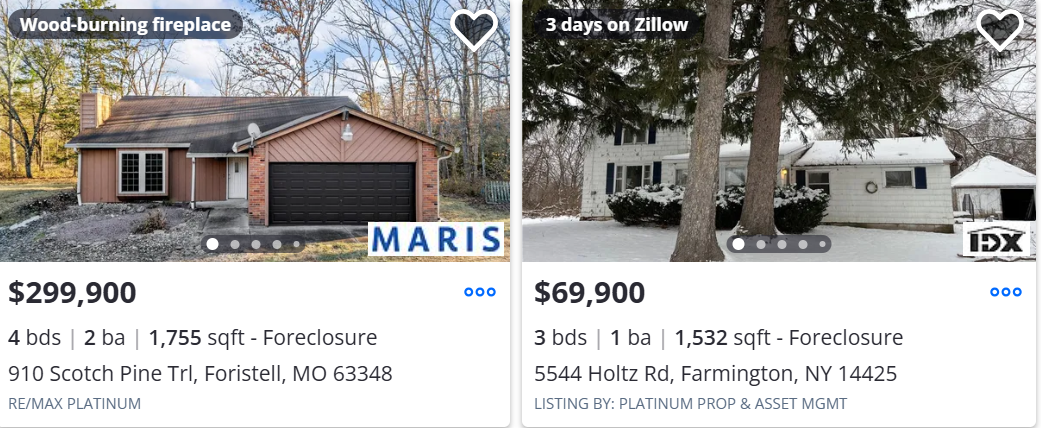

Find Foreclosed Properties: Buyers can find foreclosures through various channels, including real estate agents specializing in distressed properties, online real estate platforms, and local government websites. Additionally, foreclosure auctions are often advertised in newspapers or online.

Get Pre-Approved for Financing: Before making an offer, it is advisable for buyers to secure pre-approval for a mortgage. This step provides a clear picture of how much they can afford and strengthens their position when negotiating with sellers.

Conduct Due Diligence: Once a suitable property is identified, buyers should conduct thorough inspections and evaluations. This may include assessing the property's condition, estimating repair costs, and reviewing any liens or outstanding obligations that may affect the purchase.

Make an Offer: Buyers can submit an offer to purchase the property, either through an auction process or by negotiating directly with the lender. In some cases, lenders may be open to negotiating the sale price, especially if the property has been on the market for an extended period.

Complete the Purchase: Upon acceptance of the offer, buyers will need to finalize financing arrangements and complete any necessary legal documentation to transfer ownership. It is advisable to work with a real estate attorney to navigate the complexities of the transaction.

Advantages of Buying Foreclosed Properties

Investing in foreclosed properties offers several benefits:

Lower Purchase Prices: One of the most significant advantages of buying a foreclosed property is the potential for acquiring it at a substantially lower price than the market value. This allows buyers to maximize their investment and potentially realize considerable equity once the property is renovated or resold.

Opportunity for Renovation and Value Addition: Many foreclosures require repairs or renovations, providing buyers with the opportunity to customize the property to their liking. By improving the property, buyers can significantly increase its value, making it a lucrative investment.

Less Competition: While the market for foreclosures can be competitive, it may still offer less competition than traditional home buying. This can be advantageous for savvy buyers who are willing to navigate the complexities of purchasing distressed properties.

Potential for Quick Resale: With the right strategy, buyers can quickly resell renovated foreclosures for a profit. Investors often look for properties that can be flipped or rented out, creating a steady stream of income.

Tax Benefits: Depending on local laws and regulations, buyers may be eligible for certain tax benefits related to real estate investments, including deductions for mortgage interest and property taxes.

Related Articles

Exploring Jobs as a Construction Site Security Guard

Nov 22, 2024 at 9:44 AM

What is a CDL Truck Driver and How to Become a CDL Truck Driver

Dec 4, 2024 at 7:01 AM

Laser Eye Surgery for Vision Correction: Affordable, Effective, and Life-Changing Treatment

Nov 29, 2024 at 9:42 AM

Unlocking the Power of Unlimited Hotspot Plans: Stay Connected Anywhere

Nov 14, 2024 at 6:20 AM

Electrician Services and Training: Your Path to Becoming a Professional Electrician

Dec 19, 2024 at 7:21 AM

Patio Deck Design and Installation Companies in Florida: Creating Your Dream Outdoor Space

Sep 27, 2024 at 12:50 PM

Kitchen Remodel: Transform Your Space into a Modern Masterpiece

Dec 17, 2024 at 9:21 AM

Streamline Your Finances with Our Easy Accounting Software

Nov 15, 2024 at 11:01 AM

The Benefits of Government Funded HGV Courses: How to Get Your License?

Dec 16, 2024 at 8:22 AM

Energy conservation and emission reduction starts here: Professional energy services to support you!

Sep 27, 2024 at 1:18 AM

Always seek the advice of a qualified professional in relation to any specific problem or issue. The information provided on this site is provided "as is" without warranty of any kind, either express or implied, including but not limited to the implied warranties of merchantability, fitness for a particular purpose, or non-infringement. The owners and operators of this site are not liable for any damages whatsoever arising out of or in connection with the use of this site or the information contained herein.

![]()

![]()